MEXICO EVOLUTION: PART 2

1970–1981: Deterioration in the 70s

The first half of this period, 1970–1976, was called Desarrollo Compartido, when economic growth and an improvement of income distribution was noticed. In the previous period there was also a growing one, but in this case there was a new objective: to reduce income inequality.

The main policy instrument was expansive which Government increased the spending. This decision had a bad impact in the economy of the State.

Economic activity fluctuated wildly during the decade, with spurts of rapid growth followed by sharp depressions in 1976 and 1982.

The public sector deficit relative to GDP reached a level of 10 percent in 1976, with a fallen after this year. In 1982, the fall in the Price of oil had a negative impact in public finances, and finally the Mexican government announced that it could not face the scheduled debt payments.

1982–1995: Crisis and reforms

The macroeconomic policies of the 1970s left Mexico's economy vulnerable to external

conditions. These facts turned against Mexico in the early 1980s, and caused the worst

recession since the 1930s.

Macroeconomic situation in Mexico was difficult, as we can see, they devaluated their national currency "peso" three times in only one year (1982) and after that there was a big inflation between 1986 and 1987

Macroeconomic situation in Mexico was difficult, as we can see, they devaluated their national currency "peso" three times in only one year (1982) and after that there was a big inflation between 1986 and 1987

Many reforms arised during 1988–1994, the main one was a continued privatization of firms

owned by the government, also, the signing of the North American Free Trade Agreement

(NAFTA), the liberalization of the banking sector, etc. There was a big change in the number of

firms that the government owns from 618 in 1988 to 252 in 1994.

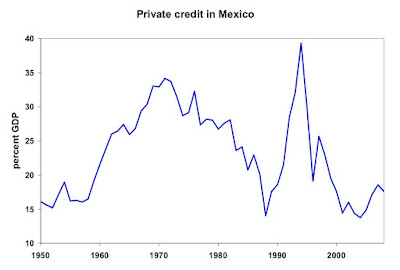

Between 1988–1994 there was a grow in the bank credit to GDP. The grow in interest

rates connote a large debt on consumers and on firms. There was a rise in past due loan

payments. These events caused that the government decided to reach the banking sector.

The financial crisis of 1994–1995 had a large negative impact on economic activity.

Real GDP per working-age person fell 8.4 percent in 1995.

1995–2007: Recovery and slow growth

Two important features of the 1995–2007 period are the rapid growth after the crisis

that started in December 1994, and the fact that the economy grew on average at the

same rate as did the United States: real GDP per working-age person grew at an average

annual rate of 1.7 percent in Mexico, the same rate as that in the United States.

The post-1995 macroeconomic situation of Mexico showed continuous improvement.

Yearly inflation, measured with the consumer price index (CPI), fell to a one-digit level in 2000.

Nominal interest rates have fallen over time.

At the end of 2000, the interest rate on a 28-day CETE was 17.05%. By 2007 it was of 7.44%.

2007–2010: Great Recession

In the period 2007–2009, the Mexican economy suffered the impact of the international

financial crisis affected the Mexican economy. The fall in economic activity was much

noticeable in Mexico than in other Latin American countries. A reason for this contraction is that the Mexican manufacturing sector is very synchronized with the economy of the United States.

By the end of 2010, the Mexican economy had recovered from the crisis. However, although the real GDP per working-age person increased 3.2 percent, it still had not recovered its pre-crisis level.

Webgraphy

Comentarios

Publicar un comentario